Amazon marketing executives realize one truth. They’ve entered complicated times. The company’s advertising revenue doubles on an annual basis. Last January, the company reported a record-breaking $3 billion in fourth-quarter profit.

Amazon’s advertising wing is soaring. But it’s hardly without complications (I’ll get to that).

Amazon realizes how new ad types can take them to a new level. They are now testing new mobile video ads. The question is, will mobile ads be for the better or, the worse?

Its shareholder report amassed $10 billion in revenue in an “other” category. The “other” category, for all intents and purposes, is advertising revenue. Amazon doesn’t provide shareholders or the public with specific advertising financials. But it’s safe to assume that the “other” category suffices this interest.

That said, these robust figures mean investor expectations are skyrocketing. But new mobile ads have both investors and Amazon execs salivating (and shivering). They salivate for increased profit. They shiver while understanding the inherent risk of more ads.

So what’s the issue?

The Amazon Mobile Ad Quandary?

It’s simple. Amazon’s advertising deployment model may be reaching its apex. Ah, those pesky consumers. They can turn on a whim if you aren’t careful.

Amazon is a website no different than any other website. All sites must consider user experience. Display ads are often one of the top threats to creating a positive website user experience.

Consumers enjoy display ads that target them. Consumers appreciate good deals on things they want and need. Website owners realize that more ads can equate to more profit.

But websites that saturate pages with too many ads risk frustrating visitors. Consumers appreciate ads until they don’t. Sites earn more money for more ads until they don’t.

Ad blocker solutions rank among the top browser extensions for this reason.

For Amazon, balancing the shoppers’ user experience with increasing ads is stressful stuff. The company desires increasing profits. The shareholders yearn for quarterly reports that blow out expectations.

But shareholders and Amazon executives can’t allow shoppers to become jaded and bitter. Once display ads reach critical mass, that’s what happens. Because if the shopping experience becomes compromised, the revenue ship begins to sink.

Websites must challenge limits because that’s how you cap the advertising ceiling. If you don’t know the ceiling, you risk losing money. You might display too many ads, or too few. The risk runs both ways.

Amazon Realizes The Advertising Quandary

On Amazon’s advertising homepage, you’ll find mundane disclosure text.

“Ad solutions to help you find, attract, and engage millions of Amazon customers at every stage of their journey”

Amazon understands Google, Microsoft, and Apple leverage advertising. And they do it in more aggressive, profitable ways.

In 2023, Pivotal Research predicts that Amazon advertising revenue will hit $38 billion.

With almost 50% of product searches happening on Amazon, this is excellent news for digital marketers. Amazon keyword research is becoming the digital marketing trend du jour. No one’s ignoring Amazon’s scale potential. Everyone wants to join the party.

Amazon reached $10 billion in advertising revenue with a simple flick of the switch. And it’s at the forefront of $38 billion in revenue if it can capitalize on the momentum. It has a galvanized base of digital advertisers ready to divert ad funds towards them.

But advertising revenue trendlines fail to consider website real estate. And website real estate is a finite source.

Amazon Mobile Ads Are Big Stuff (For All Of Us)

Bloomberg reported Amazon’s venture into mobile video ads last Thursday.

The new video ad displays only for iOS users. As an unapologetic member of the Apple iPhone herd, I’m able to experience the new ads.

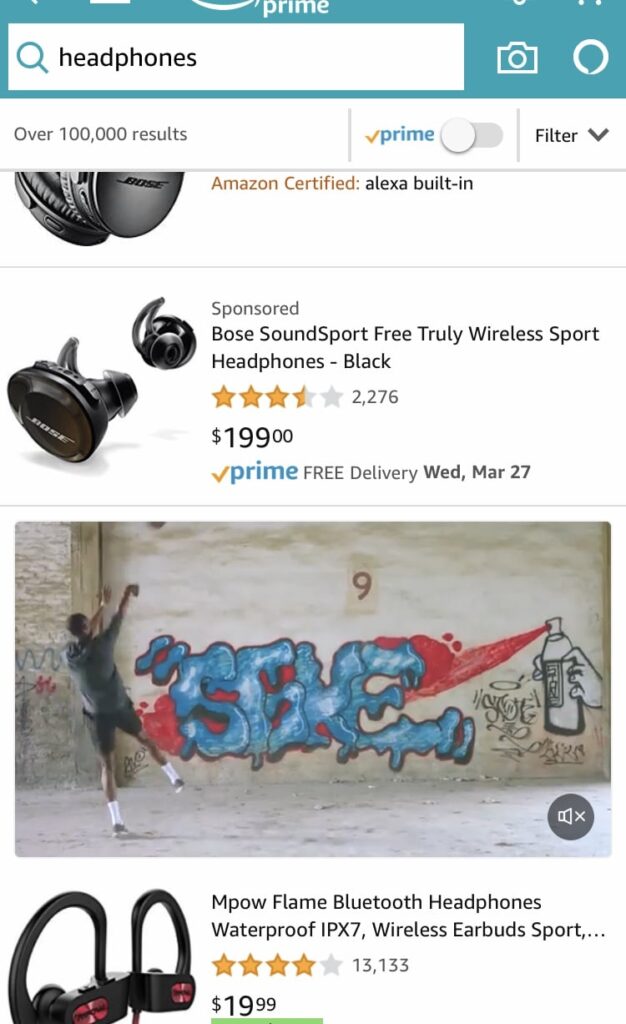

I searched for “headphones” in my Amazon app. Below is a screencap of MPOW’s Bluetooth headphone advertisement. You will notice that the MPOW’s video ad flanks industry class leader Bose’s sponsored product placement.

Let’s start with the obvious concern.

Are these new Amazon video ads intrusive?

That’s literally the billion dollar question.

We know the video ads will generate increased ad revenue if consumers don’t reject them.

From a single user’s perspective, I’ve experienced the new ads a few times over the weekend. They never feel intrusive when I encounter them. They don’t auto-play sound, or contort my shopping layout, or distract my search.

For Amazon, its investors, and its advertisers, this is excellent news. Amazon mobile ads may well accomplish all necessary goals. They don’t seem to distract or intrude; they should create revenue.

Will Mid-Sized Businesses Get a Cut Of The Amazon Mobile Ad Pie?

Amazon plans to launch these video ad opportunities in AMS (Amazon Marketing Services). The move may confuse some advertisers expecting them to show up in Demand Side. Amazon will bill marketers on a cost-per-view model. Amazon utilizes cost-per-click setups for all other ad buys, so it’s worth noting.

The new ads only appeal to big brands with big advertising budgets. The Bloomberg report says Amazon requires a two-month ad spend commitment of roughly $17k per month. That squashes the hopes of smaller businesses wanting a piece of Amazon’s mobile video ad pie (for now). But it isn’t clear if spend commitments will be permanently instituted, or just used for the testing phase.

Amazon spend commitments help them get meaningful insights. The company doesn’t want to manage thousands of new mobile video advertisers to start. They need to understand their limitations, value, and shortcomings. They need to structure appropriate pricing. The spend limits turn down the volume on other functions, such as affiliate services.

Conclusion

Amazon mobile ads help the company position itself beyond other tech giants. The advertising expansion means more revenue for marketers and investors. Amazon advertising is thriving, but new ad deployment risk the critical shopping experience.

The new mobile ads do not appear to distract from the shopping experience. This means Amazon’s ad revenue is likely to explode. As it stands, only big brands can afford to run video ads, but that may change when the testing phase ends.

Interested in discovering how your business can get more out of the Amazon platform? Learn more about our Amazon marketing services before reaching to us.